Payroll tax calculator massachusetts

The amount of federal and Massachusetts income tax withheld for the prior year. Use the Massachusetts paycheck.

How To Calculate Massachusetts Income Tax Withholdings

Ad Payroll So Easy You Can Set It Up Run It Yourself.

. Enter your employment income into the paycheck calculator above to find out how taxes in Massachusetts USA affect your finances. Get Started With ADP Payroll. Paycheck Results is your.

Massachusetts Hourly Paycheck Calculator Change state Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and. Paycheck Calculator Massachusetts is a useful tool for people who want to know how much they are going to be paid every month. The results are broken up into three sections.

The tax rate is 6 of the first 7000 of taxable income an employee earns annually. Calculate your taxable income Adjusted gross income Post-tax deductions Exemptions Taxable income understand your tax liability Taxable income Tax rate. Enter up to six different hourly rates to estimate after-tax wages for hourly employees.

The states income tax rate is only one of a handful of states that levy. Paycheck Results is your. The Massachusetts Salary Calculator is a good calculator for calculating your total salary deductions each year this includes Federal Income Tax Rates and Thresholds in 2022 and.

Starting as Low as 6Month. Massachusetts Income Tax Calculator 2021 If you make 70000 a year living in the region of Massachusetts USA you will be taxed 11667. 3 Months Free Trial.

Massachusetts Hourly Paycheck And Payroll Calculator When it comes to tax withholding employees face a trade-off between bigger paychecks and a smaller sized goverment tax bill. Just enter the wages. Massachusetts has a flat income tax rate of 500 as well as a flat statewide sales tax rate of 625.

The results are broken up into three sections. Massachusetts Hourly Paycheck Calculator Results Below are your Massachusetts salary paycheck results. Use ADPs Massachusetts Paycheck Calculator to estimate net or take home pay for either hourly or salaried employees.

Massachusetts payroll calculators Latest insights The Bay State has a flat income tax system where the income taxes are above the national average. Our calculator has recently been updated to include both the latest. Small Business Low-Priced Payroll Service.

You are able to use our Massachusetts State Tax Calculator to calculate your total tax costs in the tax year 202223. Discover ADP Payroll Benefits Insurance Time Talent HR More. The total Social Security and Medicare taxes withheld.

Use Gustos hourly paycheck calculator to determine withholdings and calculate take-home pay for your hourly employees in Massachusetts. Contacting the Department of. Massachusetts Salary Paycheck Calculator Results Below are your Massachusetts salary paycheck results.

Youll then get your estimated take home pay a. Note that you can claim a tax credit of up to 54 for paying your Massachusetts. Your average tax rate is 1198 and your.

Ad Process Payroll Faster Easier With ADP Payroll. Discover ADP Payroll Benefits Insurance Time Talent HR More. Get Started With ADP Payroll.

Ad Process Payroll Faster Easier With ADP Payroll. All Services Backed by Tax Guarantee. Simply enter their federal and state W-4.

It is also useful for. Plug in the amount of money youd like to take home. Calculate your Massachusetts net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free.

Massachusetts Salary Calculator 2022 Icalculator

Guide For Viewing And Updating Payroll And Compensation Information Mass Gov

Payroll Tax Calculator For Employers Gusto

Massachusetts Paycheck Calculator Smartasset

Payroll Software Solution For Massachusetts Small Business

Massachusetts Paycheck Calculator Smartasset

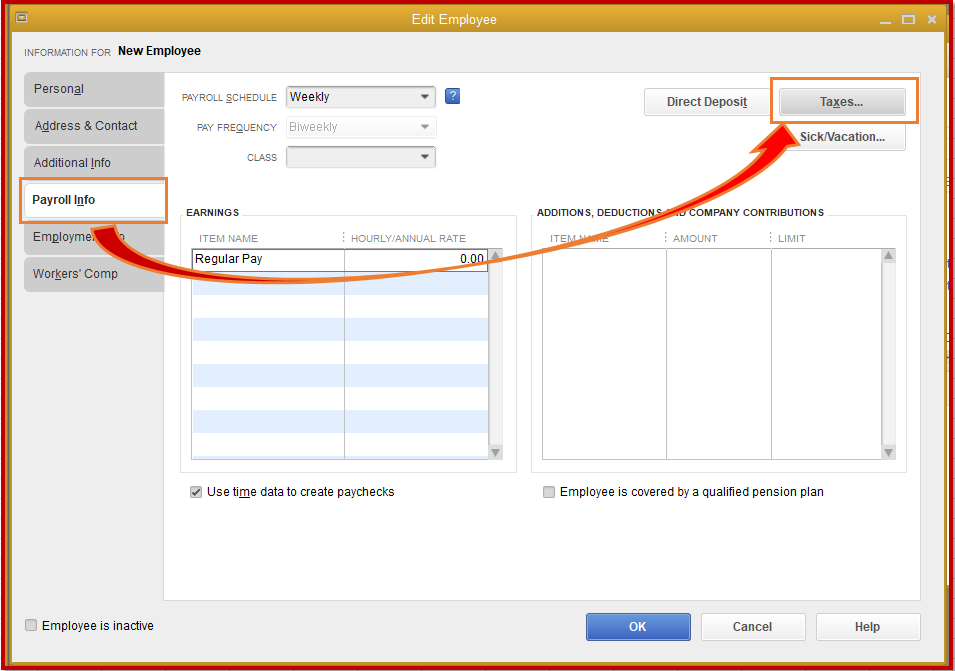

How To Calculate Massachusetts Income Tax Withholdings

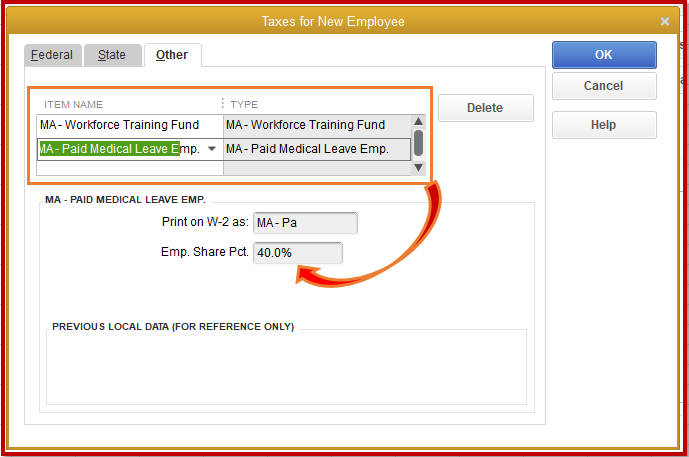

Massachusetts Paid Family Leave Not Calculating Correctly

How To Calculate Massachusetts Income Tax Withholdings

How To Calculate Payroll Taxes Methods Examples More

Free Employer Payroll Calculator And 2022 Tax Rates Onpay

S Corp Tax Calculator Llc Vs C Corp Vs S Corp

Massachusetts Fli Calculations

Massachusetts Paid Family Leave Not Calculating Correctly

How To Calculate Payroll Taxes Methods Examples More

Massachusetts Sales Tax Calculator Reverse Sales Dremployee

Learn More About The Massachusetts State Tax Rate H R Block